after tax income calculator iowa

Iowa Income Tax Calculator 2021. Using the annual income formula the calculation would be.

Iowa Income Tax Calculator 2022 2023

You can alter the salary example to illustrate a different filing status.

. Single Head of Household Married Filing Joint. The state income tax rate in Iowa is progressive and ranges from 033 to 853 while federal income tax rates range from 10 to 37. 60000 After Tax Explained.

Many of Iowas 327 school districts levy an income surtax that is equal to a percentage of the Iowa taxes paid by residents. Your average tax rate is 1648 and your marginal tax rate is 24. This is a break-down of how your after tax take-home pay is calculated on your 60000 yearly income.

That means that your net pay will be 43543 per year or 3629 per month. Annual Income 15hour x 40 hoursweek. The above calculator assumes you are not married and you have no dependants so the standard deduction per annum is 12950 USD.

What is the income tax rate in Iowa. Unlike the Federal Income Tax Iowas state income. If you make 55000 a year living in the region of Iowa USA you will be taxed 11457.

After Tax Income Calculator Iowa. Appanoose County has an additional 1 local income tax. Compare your take home after tax and estimate your tax.

C1 Select Tax Year. If you make 119491 a year living in the region of Iowa USA you will be taxed 29697. Use ADPs Iowa Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

If you make 74971166 in Iowa what will your paycheck after tax be. The Iowa Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023 and Iowa State Income. To use our Iowa Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

The Iowa Income Taxes Estimator. Tax March 2 2022 arnold. State Tax is a progressive tax in addition to the.

If you earn 60000 in a year you will take home. After Tax Income Calculator Iowa. Just enter the wages tax withholdings and other information required.

C2 Select Your Filing Status. Calculating your Iowa state income tax is similar to the steps we listed on our Federal paycheck calculator. 2023 Iowa Tax Tables with 2023 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

With five working days in a week this means that you are working 40 hours per week. Estimate Your Federal and Iowa Taxes. This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment.

So the tax year 2022 will start from July 01 2021 to June 30 2022.

Federal Income Tax Calculator Estimator For 2022 Taxes

Car Tax By State Usa Manual Car Sales Tax Calculator

Iowa Sales Tax Guide And Calculator 2022 Taxjar

United States Us Salary After Tax Calculator

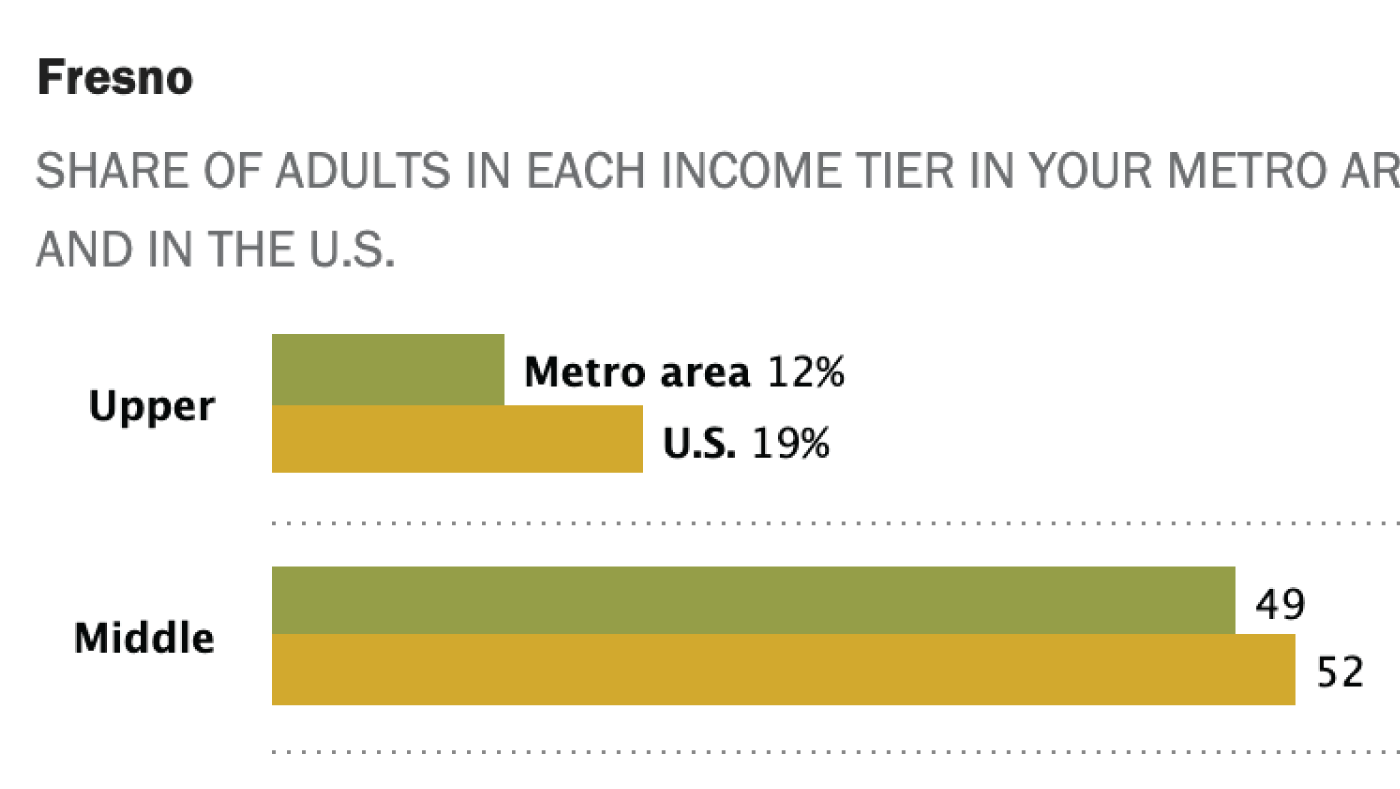

Iowa Income This Calculator Can Tell You If You Are Upper Middle Or Lower Class

Iowa Conference Free Clergy Tax Video

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

1099 Tax Calculator How Much Will I Owe

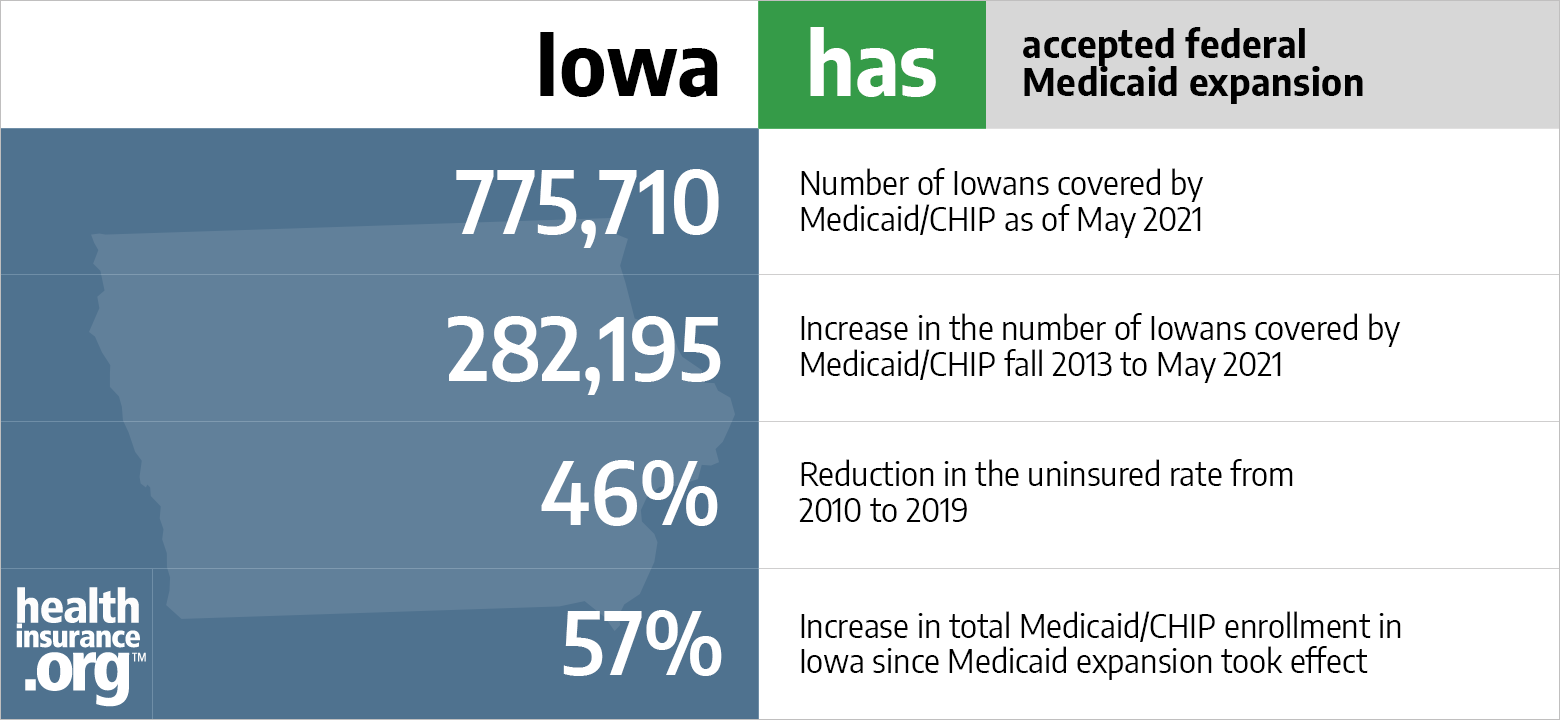

Aca Medicaid Enrollment In Iowa Updated 2022 Guide Healthinsurance Org

Capital Gains Tax Calculator Estimate What You Ll Owe

New York Hourly Paycheck Calculator Gusto

Are You In The U S Middle Class Try Our Income Calculator Pew Research Center

Cost Of College College Savings Iowa 529 Plan

Llc Tax Calculator Definitive Small Business Tax Estimator

Iowa Sales Tax Small Business Guide Truic

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Iowa Paycheck Calculator Tax Year 2022

Iowa Income Tax Calculator Smartasset

Free Online Paycheck Calculator Calculate Take Home Pay 2022